Inspirating Tips About How To Avoid Ir35

The greater the number of clients, and the shorter each engagement is, the more likely it is that you are running a business rather than being an employee.

How to avoid ir35. Mistakes to avoid when preparing for ir35 reform. Ir35 has been around for a while now and although the government. 1) if you vary your hours instead of working the standard week, that will help greatly to be outside ir35.

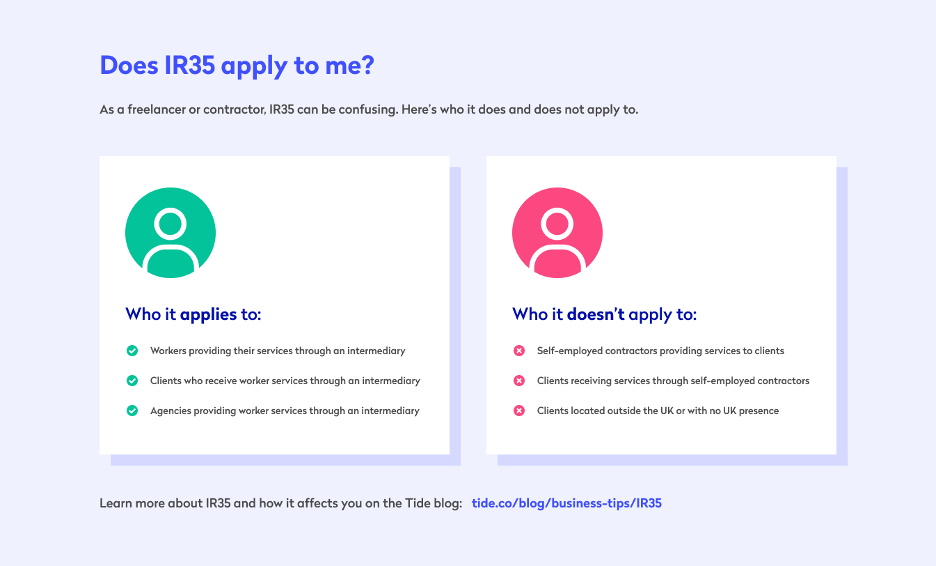

If you are a contractor providing your services through an intermediary such as your own limited company, or personal service company (psc), ir35 cannot and should not be avoided. So, here are ten steps that you can take so that ir35 won’t apply to you: Just to be clear, you can't avoid ir35, you are either in it or outside the scope of it.

A sea change in the contracting world will hit the private sector next april. There are several ways you can avoid ir35, although they may not be palatable to you or your customers. The very best ir35 advice to limited company contractors is not on how to win cases against hmrc, but how to avoid an ir35 investigation in the first place.

It's hard to avoid the conversation of ir35 especially when you. Hmrc has recently published its policy paper explaining how it intends to help and support organisations which must comply with. Contractors seeking to avoid being targeted for an ir35 investigation by hmrc can adopt a range of strategies that will help reduce the likelihood of their being targeted for a review.

Try to work a different number of. A leading adviser on employment status has updated her exclusive guidance for contractoruk on how contractors can avoid ir35, in. Stop working with independent freelancers.

In this video i talk about how you can work in your limited company and not fall under ir35. However the upfront answer to the original question is, you can’t avoid ir35. Don’t try to avoid ir35.

.jpg)